With Christmas now behind Jamaicans, better financial management is one of the resolutions that many have made for 2018 to improve their financial status.

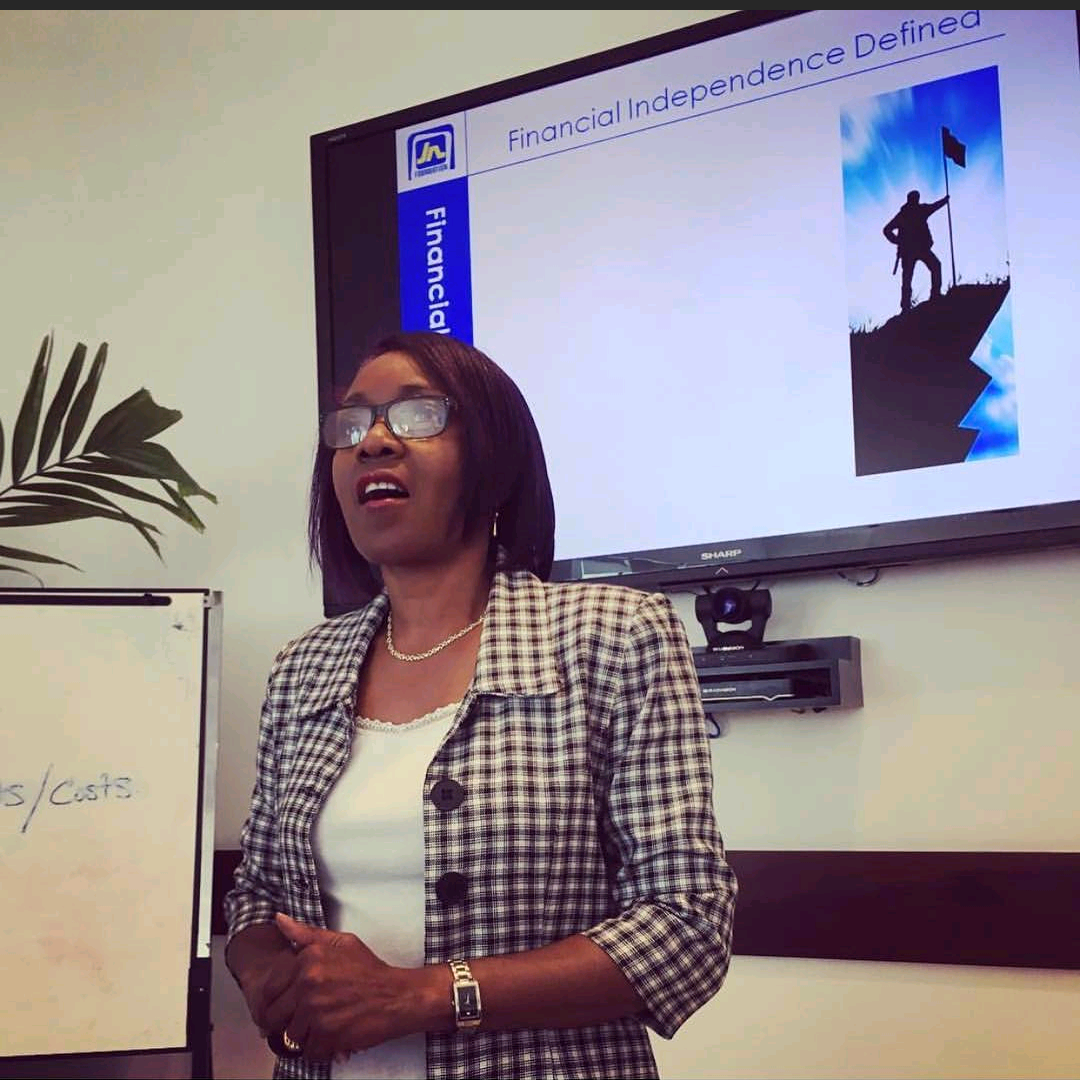

However, managing one’s financial affairs must start with the most basic financial tool – a budget – maintains Rose Miller, grants manager at the JN Foundation, who also leads the organisation’s financial empowerment programme.

Creating a budget, in itself, is also a process, she advises; therefore, crafting one must be a thoughtful exercise. She recommends the following:

Understand Your Finances

“Identify all the sources from which you earn your income. Many persons believe that their salary is their only source of income, although they also have passive income.”

Miller says that all wages, dividends, rental income, remittances, interest payments, and other earnings received are regarded as income and should be treated as such.

Keeping track of one’s money is also critical to understanding one’s finances she says.

“Everyone should maintain a record of all the money they receive and spend over a given period,” Miller underscores, “as it helps to determine the total sum received during a given period, not only from salary; but, also from other sources of income they may receive.”

She says this is especially important during the initial stages of creating one’s budget, as it will confirm exactly how much one is earning; and how much is being spent and on what.

In order to properly track spending, storing receipts relating to purchases is important, she says.

“Keeping your receipts help you to track all of your purchases and payments including: utility bills, grocery receipts, credit card and other loan payments. That process allows you to have a clear idea of all the expenses you cover over a particular period; and highlights any outstanding payments you may have,” she explains.

She notes that people may choose to store the physical receipts or scan and store them digitally.

Identify Your Needs Vs Wants

In order to design a successful budget, one needs to differentiate between needs and wants, Miller advises, and one should plan to take care of needs before wants.

“Design your budget in such a manner that your needs become your priority. Take care of basic services and items, such as utilities, basic food items and transportation, before purchasing non-essential items,” she points out.

Identify Unnecessary Expenditures

During the budgeting process, one must ensure that expenditure never exceeds income, Miller advises.

To mitigate this, she encourages persons to add their monthly income and tally their monthly expenditure and then subtract total expenditures from total income. If there is a negative balance, then it means that one’s expenses are more than one’s income; and one will need to eliminate or reduce some expenditures. “However, if there is a surplus, then, clearly, they are one the right track,” Miller maintains.

Identify Ways To Improve Your Income

Miller points out that there are ways to supplement one’s income. Some means could include getting a better paying job; using your skills or a hobby to earn; or obtain a part-time job.

Save

The JN Foundation financial literacy expert notes that savings must form an integral part of one’s budget.

She encourages everyone to develop the habit of saving a minimum of 10 per cent of their income, by treating it as part of their expenditure. It’s a good idea to try and live on a portion of your income. So don’t seek to spend all that you earn.

“Saving isn’t easy for some persons; however, no matter how small your current income is, if you plan a budget and manage it wisely, you can indeed save and from this saving, invest and begin your journey to financial freedom,” she says.With Christmas now behind Jamaicans, better financial management is one of the resolutions that many have made for 2018 to improve their financial status.

However, managing one’s financial affairs must start with the most basic financial tool – a budget – maintains Rose Miller, grants manager at the JN Foundation, who also leads the organisation’s financial empowerment programme.

Creating a budget, in itself, is also a process, she advises; therefore, crafting one must be a thoughtful exercise. She recommends the following:

Understand Your Finances

“Identify all the sources from which you earn your income. Many persons believe that their salary is their only source of income, although they also have passive income.”

Miller says that all wages, dividends, rental income, remittances, interest payments, and other earnings received are regarded as income and should be treated as such.

Keeping track of one’s money is also critical to understanding one’s finances she says.

“Everyone should maintain a record of all the money they receive and spend over a given period,” Miller underscores, “as it helps to determine the total sum received during a given period, not only from salary; but, also from other sources of income they may receive.”

She says this is especially important during the initial stages of creating one’s budget, as it will confirm exactly how much one is earning; and how much is being spent and on what.

In order to properly track spending, storing receipts relating to purchases is important, she says.

“Keeping your receipts help you to track all of your purchases and payments including: utility bills, grocery receipts, credit card and other loan payments. That process allows you to have a clear idea of all the expenses you cover over a particular period; and highlights any outstanding payments you may have,” she explains.

She notes that people may choose to store the physical receipts or scan and store them digitally.

Identify Your Needs Vs Wants

In order to design a successful budget, one needs to differentiate between needs and wants, Miller advises, and one should plan to take care of needs before wants.

“Design your budget in such a manner that your needs become your priority. Take care of basic services and items, such as utilities, basic food items and transportation, before purchasing non-essential items,” she points out.

Identify Unnecessary Expenditures

During the budgeting process, one must ensure that expenditure never exceeds income, Miller advises.

To mitigate this, she encourages persons to add their monthly income and tally their monthly expenditure and then subtract total expenditures from total income. If there is a negative balance, then it means that one’s expenses are more than one’s income; and one will need to eliminate or reduce some expenditures. “However, if there is a surplus, then, clearly, they are one the right track,” Miller maintains.

Identify Ways To Improve Your Income

Miller points out that there are ways to supplement one’s income. Some means could include getting a better paying job; using your skills or a hobby to earn; or obtain a part-time job.

Save

The JN Foundation financial literacy expert notes that savings must form an integral part of one’s budget.

She encourages everyone to develop the habit of saving a minimum of 10 per cent of their income, by treating it as part of their expenditure. It’s a good idea to try and live on a portion of your income. So don’t seek to spend all that you earn.

“Saving isn’t easy for some persons; however, no matter how small your current income is, if you plan a budget and manage it wisely, you can indeed save and from this saving, invest and begin your journey to financial freedom,” she says.

See the original article here!