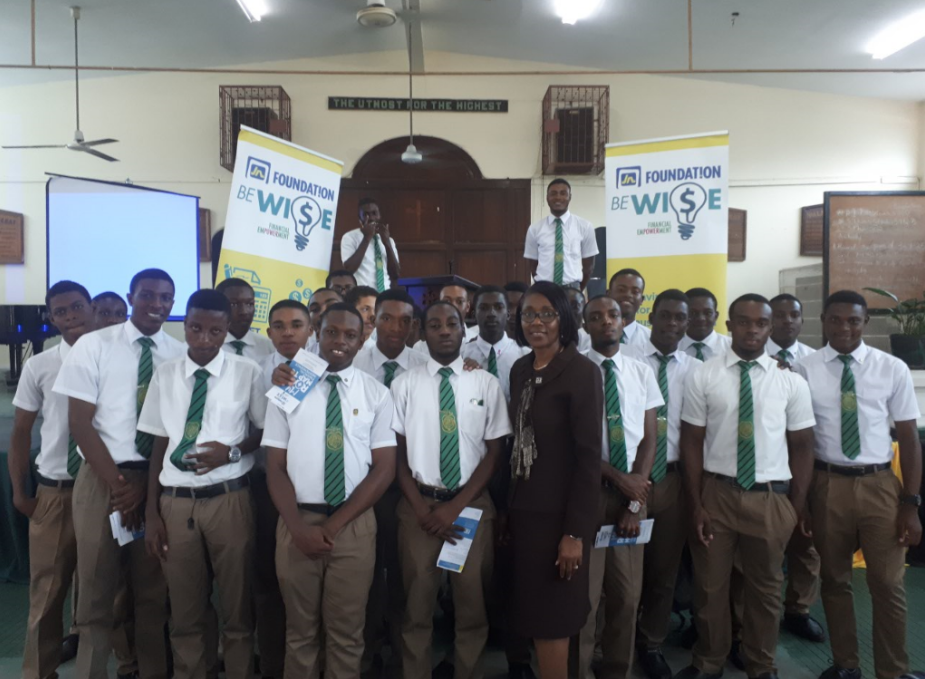

Some 200 students from two Kingston-based high schools recently benefitted from sensitisation sessions about financial literacy. The outreach briefings were organised by the JN Foundation, in observation of “World Savings Day” on Tuesday, October 31.

The savings briefings were delivered at Jamaica College and Calabar High Schools, under the foundation’s Be Wi$e Financial Empowerment Project, with students being informed about budgeting, the importance of savings, credit and insurance, the four tools of financial independence ,

Rose Miller, grants manager at JN Foundation, who delivered the presentations, urged students to make saving a daily practice; and pointed out that it was ideal to save a minimum of 10 per cent of one’s monthly income; or monetary gifts received.

“Saving is critical to achieving financial independence and, believe it or not, saving is only the beginning. After you have saved, then you can move on to making investments, because it is through investing that one can gain financial freedom. However, if we have nothing saved, then we will have nothing to invest,” she informed.

In explaining the process of budgeting, Mrs. Miller told students that they should be able to differentiate between “needs and wants,” and she pointed out to the surprise of many of the students that “a cellular phone was not a need.”

“You may ask me to leave when I tell you this: A cell phone, especially a high-end phone, is not a need, it is a want and, part of being financially literate is that you need to recognize ‘what is a need and what is a want’,” she advised.

She further explained that ones budget should be realistic and flexible. “Write down the elements of your budget beginning with the most important expenses; those classified as needs; revise it, as necessary. Successful budgeting requires discipline, so stick to your budget.”

Raheem Campbell, an eighth grader at Calabar High School, said the session was most informative. “I learned that financial freedom is the best way that you can be free from financial problems,” he said.

Meanwhile, sixth former, Dajanae Edge, said that the information about budgeting was very useful to him. “I learned that budgeting is critical to financial independence; and that saving is also a form of financial empowerment,” he related.

World Savings Day was observed under the theme “Our Future Starts With Savings.”JN Bank, a member of The Jamaica National Group, also rolled out a series of activities on the day, including: launching the #findaway Savings Campaign, in which the bank seeks to further educate its members and the public about the value of thrift.

-30-

Contact: Dionne Rose l JN Corporate Communications l JN Bank l Tel: 936-3367 l Email: drose@JNGroup.com l