Hundreds of JN Members Experience the Christmas Spirit of Giving

JN members across the country were reminded about the importance of “gifting” through receiving encouragement and tips befitting the Christmas season from the JN Foundation’s five current projects.

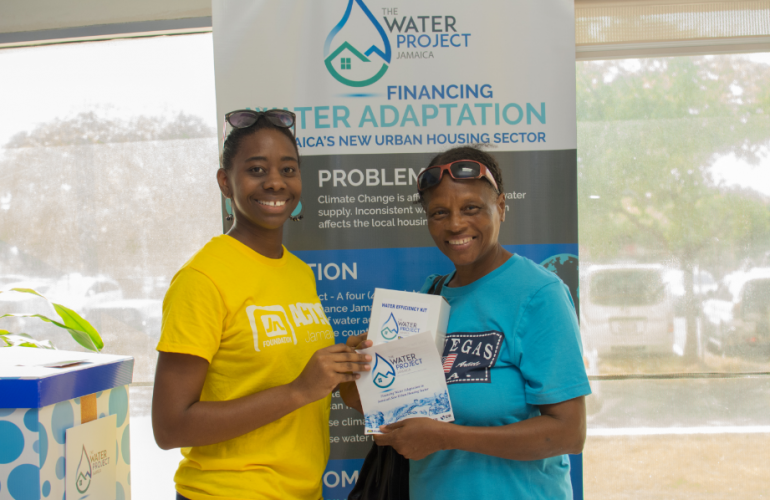

Through a series of ‘one-on-one’ engagements about road safety, water conservation measures, passing on our Jamaican heritage, financial security and supporting local brands, by buying social, the Foundation reached hundreds of its members with heartfelt messages and tokens.

Rose Miller, grants manager at the JN Foundation, said that the Christmas initiative entitled “JN Foundation Gift of Christmas…” involved educating members about: road safety, financial literacy, water conservation, social good and parish histories.

“We have been “putting people first,” at these in-branch meetings across the country; and engaging them about the gift of conservation through our Water Project, by providing them with conservation tips about technologies, which can be used to assist them to maximize, and efficiently use water, particularly during the holidays when they may be entertaining visiting friends and family,” she explained.

Mrs Miller informed that members were also alerted to financial tips, through the Foundation’s Be Wise Programme, which advises members about how they can maximize their earnings and make wise financial decisions during the Christmas Season.

“Be financially wise this Christmas, make a budget, to track your spending and do not get carried away,” Mrs Miller advised; noting that, “for those who receive bonuses, they should consider investing some of the money.”

The JN Foundation grants manager also pointed out that it is important to be safe on the road. “We have been engaging members about the “Gift of life” through road safety tips about ensuring the safety of all road users during the season,” she related.

There was also the Gift of Community, to sensitize members about the Christmas specials being offered by various social enterprise companies.

Nelson Quarry, a JN member who participated in the engagement, appreciated the oral history tip, and suggested that adults should encourage children to be more attentive to the historic stories being told to them by their elders; this will help them understand our history and be in a position to pass it on to future generations.

“This is a good initiative, which is encouraging,” Mr Quarry said, “I like it and I hope that you will continue these events,” he said. “As it relates to the tip, this is something that I have always thought about and have encouraged.”

Alicia Godfrey, another JN Member, appreciated the conservation tips; and expressed her delight for the information to replace inefficient plumbing fixtures with water saving ones, which are either ‘Water Sense’ labeled, or use 20-25 per cent less water than standard units.

According to the National Water Commission, water consumption at home can be reduced by as much as 30 per cent by using proper water saving devices; and the adoption of good conservation practices.

The “JN Foundation Gift of Christmas…” promotion was successful in reaching hundreds of members at JN Bank branches in Falmouth, Trelawny; Ocho Rios, St. Ann; May Pen, Clarendon; Spanish Town, St. Catherine; Duke Street in Kingston and at Half-Way-Tree, St. Andrew.

Contact: Dionne Rose l JN Corporate Communications