A group of 15 persons, comprising engineers, developers, students, and water experts, graduated from a 16-week rainwater harvesting and grey-water-recycling training programme recently.

The training programme was organised by the JN Foundation in collaboration with the Inter-American Development Bank (IDB) through the Water Project Jamaica.

Edward Shakes, one of the graduates, said, “The course was engaging, yet flexible, and, it was a remarkable, enlightening, and vital learning experience.”

Shakes, an engineer, stated that the course allowed him to design and scale a rainwater-harvesting system, that he will construct for his parents, who reside in Manchester, as he is now aware that the system is suited for the parish, based on its heavy rainfall.

TIMELY COURSE

For Coleen Williams, a householder, the course was timely, considering the effects of climate change, and she welcomed the applicable skills that participants learnt during the 16-week programme.

“It is knowledge to share. I can now speak from the choir to the choir,” she said, adding that she learnt a lot during the 16 weeks.

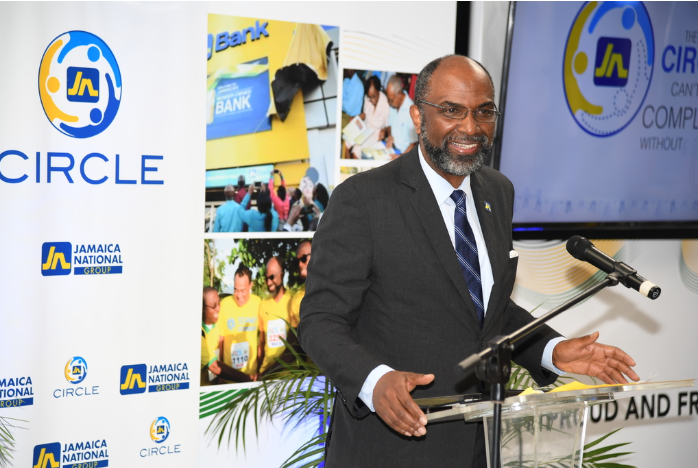

Onyka Barrett Scott, general manager of the JN Foundation, stated that the graduates were ahead of the curve, given that they were the first batch to be trained in rainwater harvesting and grey-water recycling.

“Today, we are proud to be recognising graduates who are armed with knowledge about rainwater harvesting and grey-water recycling; therefore, we are confident that they will effectively implement what they learnt,” she said.

The JN Foundation’s general manager explained that the aim of the initiative is to build local capacity in the design and installation of a variety of water-efficient measures in the housing sector. Participants were exposed to the components of rainwater harvesting systems, water-saving devices that can be implemented by homeowners to save water; and factors that affect water quality, as well as water standards.

Barrett Scott explained that, in the case of Jamaica, droughts and the shifting patterns of rainfall are already creating serious challenges that negatively impact the country’s water supply and distribution systems.

She also noted that the problem of inconsistent water supply has a devastating effect on families, institutions, and communities and affects the business models of housing developers and construction companies, as was experienced this past summer.

In addition, she stated that limited financing and an uncertain business case for water adaptation are barriers to the uptake of water-efficient measures by the housing development sector.

“The Water Project Jamaica, therefore, aims to tackle these issues through the provision of an impactful, scalable model which will enhance Jamaica’s climate resilience,” she posited.

Senator Pearnel Charles jr, minister without portfolio in the Ministry of Economic Growth and Job Creation, commended the JN Foundation and its partners for the training and added that it was a demonstration that they are thinking outside of the box.

He encouraged the graduates to implement what they had learnt. “I’m challenging you, so that, it does not become another line on your “résumé,” he told them.

The minister underscored the importance for the country having strong water-policy guidelines; and gave his commitment to move the plan from draft stage to legislative format. “We have to press on the gas to have it completed,” he affirmed.